Talking Banks - With Joe Fenech & Kevin Swanson Issue 1

In This Issue (#1):

- An introduction to the “Talking Banks” newsletter

- Bullish on banks, but still navigating some rough terrain

- NYCB-triggered CRE risk overstated, but overhang will linger

- Bank stock observations

Since this is our first newsletter, we’ll start by explaining why we’re doing this and what our readers can expect going forward. We hope you’ll give us feedback on what you like, what you don’t like, and what else we should consider as we fine-tune the product. Also, expect shorter issues in the future following this initial introduction!

We’re doing this for a couple reasons:

To provide a platform to comment on industry developments and connect with a broader audience in more of a real-time format. Also, we miss aspects of our former careers as research analysts and this helps us scratch the itch, without the burdens of stock ratings, price targets, and EPS estimates.

What you can expect:

- A conversational style of communicating. We manage an investment fund and we’ve written quarterly letters to our investors since late 2020. Our quarterly letters are deep dives and are geared towards more of a bank-specific audience. Our intent is for this to be a little different.

- We’ll write when we have something to say, not based on a pre-arranged schedule. Some comments may seem “off the cuff” but be assured that all topics are meticulously researched, we just won’t bore you with the details.

- Conversations with industry experts, including webinars and long-form interviews.

- Disclosures highlighting if our investment fund has a position in any company/stock discussed.

With that said, let’s jump in

Bullish on bank stocks, but still navigating some rough terrain

- After the bank failures last year, we said in our quarterly investment letter that we thought a new bank stock investment cycle was underway, and that it would prove rewarding to investors in the years ahead. We felt that valuations were as compelling as we’d ever seen; we thought we’d see normalization but not devastation of asset quality; we saw Fed policy moving from headwind to tailwind; and we believed that a consolidation wave would soon take hold, which historically has been a boon to bank stock prices. We still feel that way today.

- But we also said that the path back to “normal” would likely include some twists, turns, and maybe even a pothole along the way. And that’s pretty much what’s transpired. Bank stocks are higher than they were around the middle of last year, but have been severely tested at times, first by the rekindling of rate fears in the late summer/early fall and then more recently by the disclosure from New York Community Bank, which ignited fears around asset quality.

Why is everyone so skittish? A little context…

- The bank sector has been out of favor with investors since 2008 and especially since 2020, so it’s difficult to overstate the level of exhaustion people feel as the baton of concern has passed from margin erosion, to COVID, to inflation, to higher rates / QT, to liquidity, and now, to credit. In the process, generalist investors turned away from banks and haven’t really looked back.

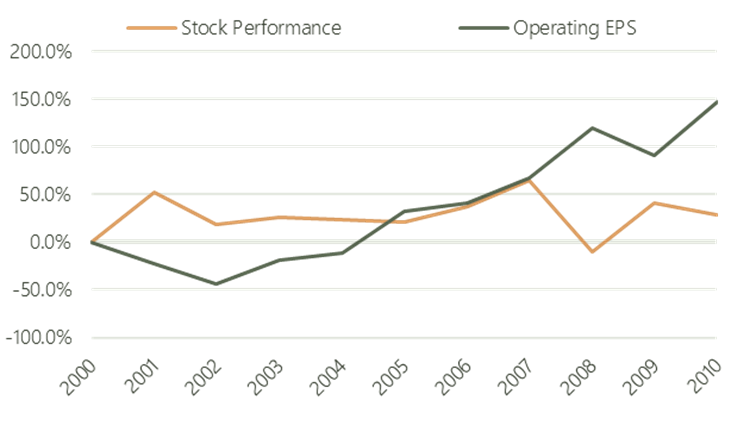

- Research from Merrill Lynch suggests that “problem sectors” take about 10 years to heal after a devastating event. We saw this with the tech sector from 2000 to 2010. As an example, Microsoft more than doubled EPS, but nobody seemed to care, as the stock was flat over this period. Since then, the stock is up 13x.

Microsoft (MSFT) Stock Price vs Operating EPS Source: S&P Global; Data as of 12/31/23

Source: S&P Global; Data as of 12/31/23

The 2008 crisis was a similarly devastating event for banks, but in our view, the sector healed itself over the next decade. Underwriting and service quality improved, new rules were established after a period of lax regulation, and incentives were better aligned. A well-deserved redemption period awaited during the 2020’s, but instead has evolved into a state of near-constant panic, brought on not by a flawed approach to risk management as in 2008, but rather by the pandemic and its destabilizing aftermath. Banks unfortunately have had a front-row seat, with every spasm, no matter how idiosyncratic, leading investors to dive back into the bunker, restarting the clock on the “show me” aspect of the sector’s recovery.

So we get the pushback, but consider the following:

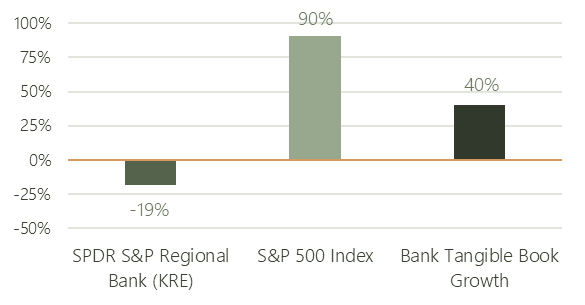

Like the Microsoft example above, banks have created value that has gone unrewarded in the market. Since 2017, banks have grown tangible book value by 40%, or 6.7% annually, in line with the LT average, and yet, the bank stock index (KRE) is down 19%. Similarly, P/E multiples for banks have contracted, while the broader market multiple has significantly expanded, by -4 and +5 multiple points, respectively.

Stock Performance Vs. TBV Growth Since 2017 Source: S&P Global; Data as of 12/31/23

Source: S&P Global; Data as of 12/31/23

- Bank sector insiders continue to buy stock through these spasms, including this year following NYCB and last year after the bank failures. Promising signals, in our view, that bankers aren’t seeing problems of the magnitude that’s been speculated. From economist Ed Yardeni: We asked Michael Brush (Market Watch columnist) for an update of insider activity: “Insider buying continues to remain particularly light relative to selling…Insiders who were buying endorsed two contrarian bets. They favored regional banks and real estate investment trusts that manage office properties. Buyers are telling us that fears about regional banks and commercial real estate are exaggerated.”

- Back to the technology sector and market dynamics. META (formerly Facebook) recently reported earnings and the stock increased by 20%+, creating over $200 bil. in market cap in one day. The market cap of Bank of America, the country’s second largest bank, is roughly $269 billion. We’re not tech experts – maybe the earnings and the outlook for these companies are really that good, and this trend can continue. Or maybe the pendulum has shifted by too much and a snapback is inevitable? JP Morgan, the sector’s preeminent institution, which thrived during the sector panic last year, trades at 11x forward earnings and just over half the multiple accorded the broader market…just sayin’.

CRE risk hysteria triggered by NYCB is overstated, but stock overhang will linger for now.

Risks around CRE have been circulating since rates headed higher but were exacerbated by the disclosures from New York Community Bank in late January. Late last year, the Wall Street Journal published an article noting that the bank sector’s exposure to commercial real estate was $3.6 trillion, including about $623 bil. of CMBS and loans to non-bank lenders.

The market has treated announcements like NYCB’s as an indictment of the entire $3.6 trillion CRE exposure. The sub-asset classes of CRE are office, multifamily, retail, and industrial. NYCB’s credit issues fell into the office and multifamily segments, where there is no denying that there are issues but…it’s complicated!

Not all office exposure is created equal... In the office segment, behavior has changed what the future looks like since COVID, with large metro area office towers experiencing higher vacancy rates due to changing workplace norms. As loans mature, higher rates create challenges for refinancing property that is now worth less, and muted deal activity inhibits price discovery.

- Lenders on office towers in major metro markets (including the most troubled like NYC, Washington DC, and San Francisco) tend to be the biggest banks, with a few exceptions. Regional and some community banks have exposure to these markets as well, but also to office real estate in other markets around the country that is faring just fine. We spoke to a small bank in the Midwest region last week that has no delinquencies within its office book, while also noting that the tallest building in the towns where they operate is about the size of a grain silo. We talk to 5 banks per week on average, and this sort of commentary is not atypical, even in more challenged markets like metro NY. Last week, a Northeast regional bank (over $50 bil. assets) told us that it’s average office loan in New York City is $6 mil., typically to a doctor operating on a low floor of a building. So not only is the NYCB disclosure not an indictment of $3.6 trillion of bank CRE exposure nationwide, it’s not even an accurate representation of banks’ office real estate exposure. Also, while there is little doubt that further problems will soon be apparent, the largest banks holding most of this exposure are best equipped in the sector to deal with it, as office RE represents less than 5% of total loans for these companies, who have also substantially built-up reserves (in some cases to 10% or more) to absorb future losses.

…and the same is true of multifamily. NYCB’s issues here relate to the rent-regulated multifamily segment in NYC, to which it is the largest lender of any bank. The idiosyncrasies of the entire NYCB situation are well-known, but less discussed is that specific concerns around multifamily are also quite likely idiosyncratic to metro New York. In 2019, the state passed the New York Housing Stability & Tenant Protection Act, limiting the ability of landlords to raise rents in line with inflation, higher rates, and financing costs. Even in California, regulations were relaxed at the end of 2023 to allow more flexibility on price increases for rent-regulated apartments. Other NYC-exposed banks report to us that rental rates are up about 30% since COVID on traditional multifamily – in other words, higher rental income is helping to absorb the impact of inflation and higher rates. So again, even within New York, let alone the rest of the country, NYCB’s issues aren’t an indictment of the broader multifamily market.

A few other points to consider as it relates to CRE armageddon fears, much of which we attribute to what we call 2008 PTSD:

- There was no Dodd-Frank in 2008. Bankers and investors always grumble about regulation, but in this case, the legislation has worked mostly as intended. The largest banks today are the most insulated from liquidity and credit issues due in large part to Dodd-Frank, whereas in 2008, they were the most exposed. By definition, you can’t have systemic risk if the largest banks aren’t part of the problem.

- The industry is much better capitalized today vs. 2008 and additional capital requirements are likely on the way.

- While it’s true that CRE concentration ratio guidelines were put into place in 2006, it was too late to address the problems that emerged in 2008. Since then, however, regulators have hewed closely to those guidelines in their scrutiny of the sector.

- The banks tend to bear the brunt of this fear because they’re highly regulated and are most transparently exposed. But private credit markets have grown more than five-fold since the last financial crisis and are expected to grow by another $1 trillion over the next five years, benefiting from the higher degree of regulatory scrutiny that has pushed a lot of this exposure out of the banking system. A report from Stephens Inc. last week noted that nonbanks hold 21% of SNC commitments, but 65% of special mention and classified SNC’s. Stocks of several of these non-bank firms are currently all the rage, trading at all-time highs, while bank stocks languish near record lows. Again, just sayin’…

In the near-term, it’s likely that these counterpoints won’t matter very much as it relates to the stocks, as the NYCB news unleashed a genie that will prove difficult to stuff back into the bottle. But it’s just not accurate to suggest that $3.6 trillion of CRE exposure is at risk because a bank in New York City took some losses on downtown office real estate and rent-regulated multifamily.

While we don’t foresee announcements of the same size and scale ($100 bil.+ asset banks) as NYCB, any stumbles by smaller banks will be seized upon as further validation of CRE armageddon fears. So while we’re confident that risks to the system and the vast majority of banks is significantly overstated, as it was following the failure of Silicon Valley Bank last year, potential risk to the stocks remains acute, and at the very least, further extends the timeline to “normalization” in this post-COVID world. For bank investors, this backdrop creates frustration and risk…but also tremendous opportunity.

Bank stock observations:

Biggest still seems best, at least for awhile longer. The four largest bank stocks were all up last year, led by JPM. Heading into this year, these stocks still seemed attractive, but more for company-specific reasons. Wells Fargo seemed closer to escaping regulatory purgatory; Citi was poised to continue its “bad to better” transformation; and JPMorgan seemed deserving of a stock re-rating on par with great companies in other sectors. As a group, they all seemed likely to benefit from proposed capital rules perhaps being watered down, leading to increased capital return, and undemanding valuations, historically speaking. Moreover, with the back-up in rates and increased likelihood of “higher for longer”, anticipated NII headwinds are dissipating, as earnings guidance that was previously based on 6 rate cuts will likely prove too conservative, while increased concern about CRE impacts these companies less. Interestingly, amidst the NYCB hullabaloo, big bank stocks have quietly broken out, with JPM now trading at an all-time high, and WFC and C trading at post-March 2023 highs.

Preferreds still screening attractive. Bank preferred stocks have set back a bit recently on the NYCB news and the back-up in rates after a strong rally post the irrational fears of systemic risk last year. With the announced Fed pivot and irrational fears taking hold (again, but this time on CRE credit), preferred stocks, many of which are still trading at deep discounts with upper single to low double-digit yields, seem attractive. Moreover, we suspect that most fixed-to-floating rate preferreds resetting this year (to low double-digit coupons) aren’t likely to be redeemed amidst the current market turmoil and ahead of the finalization of new capital rules.

Thinking through the potential trouble spots. While we think broader credit fears are overblown, the sector isn’t devoid of potential land mines. As evidenced by NYCB, a cheap valuation won’t insulate a stock following a dividend cut brought on by credit concerns and a reduced earnings outlook. For smaller banks too, share liquidity can present an extraordinary challenge in this regard. AOCI also presents headwinds to TBV growth and TCE optics as rates back up. We don’t think these issues are widespread, but the profile of a bank that’s liability sensitive in a higher-for-longer rate scenario, with heavy CRE exposure, a CECL-induced reserve that sits below peers, and a high dividend payout ratio is potentially problematic if a credit blip calls into question the sustainability of the dividend.

Topics for future newsletter issues:

- Further parsing CRE risk

- The coming consolidation wave, including MOE’s

- Thoughts and implications of banks selling insurance businesses

- Why have CFO’s been taking the fall (we think unfairly) this cycle?

Disclosures:

Of the individual stocks mentioned, our investment fund currently has long positions in Wells Fargo & Co., JPMorgan Chase & Co., and Citigroup Inc. The author(s) has long-standing long positions in Microsoft Corp. Citigroup Inc., and JPMorgan Chase & Co. in his personal investment account.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. This information does not purport to be complete, is subject to change, and is qualified in its entirety by the definitive offering documents related to any private fund managed by GenOpp Capital Management LP. All time-sensitive references are made as of the date set forth above, unless otherwise expressly indicated, and there is no obligation to update any such reference. The delivery of this information does not imply that the information is correct and no representation or warranty is made as to the accuracy of any information contained herein. This information is not a recommendation to buy any security and does not constitute any form of legal, tax, investment, or other adv