Talking Banks - With Joe Fenech & Kevin Swanson Issue 2

In This Issue (#2):

- We walk through our thoughts on developments at New York Community Bank (NYCB)

- The NYCB aftershocks continue to reverberate, but look at what else is quietly happening

- Thoughts on banks selling insurance businesses

- Bank stock observations: The S&P 500 gets all the attention, but big banks have been the place to be

- Other tidbits we found interesting

New York Community Bank

No one saw Steve Mnuchin coming. A fascinating few days of speculation surrounding the future of NYCB culminated in the announcement that former Treasury Secretary Steve Mnuchin (with former OCC head Joseph Otting installed as CEO) would lead an investor group to inject over $1 billion into the struggling bank. Mnuchin is an experienced, well-respected bank investor that stepped into a similar situation during The Great Financial Crisis of 2008 (Link to Article), and also in our view doesn’t get the credit he deserves for the ingenuity displayed as Treasury Secretary in the conception and execution of the Paycheck Protection Program (PPP) during the pandemic.

This is a heavy lift, but don’t underestimate the new team. The worst of the credit news is likely still to come, but we think the bank survives. We’re under no illusions regarding the magnitude of the job ahead, but we recall similar questions around the Mnuchin-led rescue and turnaround of IndyMac (later OneWest Bank), a company with terrible underwriting practices and questionable franchise value.

The billion dollar question is can we trust the integrity of “new” TBV. We’re not sure (and we don’t think anyone can be) if the $1 billion+ of new capital will prove sufficient. This isn’t to suggest that the company’s survival is in jeopardy if it wasn’t, as we think new investors would follow this trustworthy team into the stock once the issues have been appropriately “ring-fenced” following the deep dive that new management is conducting as we speak. Pro forma tangible book value is said to be $6.22, and the new investors are in the stock in the low $2 range. So even if additional capital is needed, the deal is still likely to be a “home run” for the investor group. The question is the math for new investors contemplating a purchase at current levels, between $3-$4 per share. Further dilution that would cut TBV to below $6 (with future earnings power still uncertain) clouds the picture quite a bit, as investors have opportunities to purchase bank stocks today at similarly compelling valuations with much less risk. Also, respect for the new team shouldn’t be construed to justify a purchase at any price. We recall the situation at the “old” BankUnited (BKU), led by John Kanas, another well-respected banker / investor, who recapped BankUnited at around $10 in early 2009, and then IPO’d the new company at $27 in 2011. The stock today sits just below the IPO price, thirteen years post-offering. The bottom line is that a great opportunity for the Mnuchin team is not necessarily a good deal for follow-on investors at higher prices. Our “hunch” is that an investment at current prices is probably a reasonable bet for long-term investors, but we don’t invest based on hunches. Our investment fund did, however, purchase NYCB’s preferred stock very shortly after it resumed trading following the capital injection announcement.

The politics of this situation matters and plays to the new team’s advantage. It’s nearly impossible to align the political “left” and “right” on any issue these days, but Mnuchin seems to have made a savvy political bet here. Rent-regulated apartment lending is not economically viable in New York given changes to the law in 2019, and this is unlikely to change anytime soon (Link to Article). That said, there was remarkably little public political opposition to this announcement from the progressive left which undoubtedly did not want to see the major lender to rent-regulated apartments (NYCB), in a city struggling with affordable housing, go down in failure. At the same time, having served as former President Trump’s Treasury Secretary, Mnuchin is likely still well-protected politically on this investment should there be a change in administration in November ’24.

This rescue has positive implications for the industry. The “old” NYCB (the company that grew out of Queens County Savings Bank following its mutual-to-stock conversion during the ‘90’s) was always a rumored acquisition candidate, but suffered from a perceived lack of franchise value, given its thrift roots. The situation improved somewhat with the acquisition of Flagstar followed by the deal to acquire Signature out of the FDIC, but questions around franchise value remain. “Smart money” private equity nevertheless stepped in here to save the bank, despite the franchise value question and problematic credit exposures, the depth of which isn’t yet known. We don’t see credit problems of similar magnitude at other large banks, but even if there were, we believe that all of these companies ($50 bil.+ in assets) have greater underlying franchise value than NYCB, suggesting that new capital likely stands at the ready should any other “situations” develop. If that’s the case, then there is a strong possibility that this event marks the bottom of the current cycle. Remember, once the risk of large bank failures was off the table following the GFC, and “smart money” PE came in to successfully recap BankUnited in May ’09, bank stocks rallied throughout the recap phase of smaller banks.

A fascinating situation should remain so over the next several months, and we’ll be watching closely.

Aftershocks of the NYCB bombshell continue to reverberate, but let’s look at what else is happening

Sentiment could hardly be worse, but who is left to sell bank stocks that hasn’t already done so? In 2008, the period of true pain for bank stock investors was relatively short. Bear Stearns went down in March 2008, Lehman and WaMu in September 2008, TARP was unveiled in October 2008, and the stocks bottomed in March 2009. The NYCB news this year was certainly a crushing blow to sentiment, but even more so because of the timing, as investors had finally started to put the events of March / May 2023 behind them and were looking ahead to the Fed pivot following a sharp rally in the stocks to close out ’23. Of course, these events came on the heels of the Fed’s punishing rate hike cycle that began in early ‘22, which came on the heels of the COVID pandemic in March ‘20. In other words, March 2024 marked the fourth anniversary of the start of this painful cycle for banks, four times as long as the cycle of pain for the stocks during the ’08 crisis, which was a much bigger problem.

But what is also quietly taking place?

- Fed pivot reconfirmed. Following a period of doubt given a few “hot” inflation reports and the recent back-up in rates, the Fed reconfirmed its intention to “pivot” from hiking rates to cutting rates at some point this year. (Link to Article).

- Yield curve steepening. At the same time, the economy remains strong, which should hold long-term rates in place (or drive them modestly higher). So following a record period of inversion, the yield curve is likely to steepen this year, reversing arguably the most significant overhang on bank stocks in this cycle (as the cycle’s biggest bear also turns more positive: JPMorgan CEO: If Rates Don’t Go Up And There’s No Recession, Most US Banks Will Muddle Through Issues). Even in a scenario in which the Fed cuts at a much slower-than-expected pace, this development should prove to be a powerful positive catalyst for bank stocks, as the market looks ahead to net interest margin expansion in ’25. On the flip side, should long-term rates unexpectedly decline alongside the reduction in short-rates, while the yield curve would remain inverted, this would help to alleviate concerns surrounding CRE credit risk, while losses on fixed income investments would decline meaningfully as well, forcing attention to the sector’s sub-TBV valuation ex-AOCI.

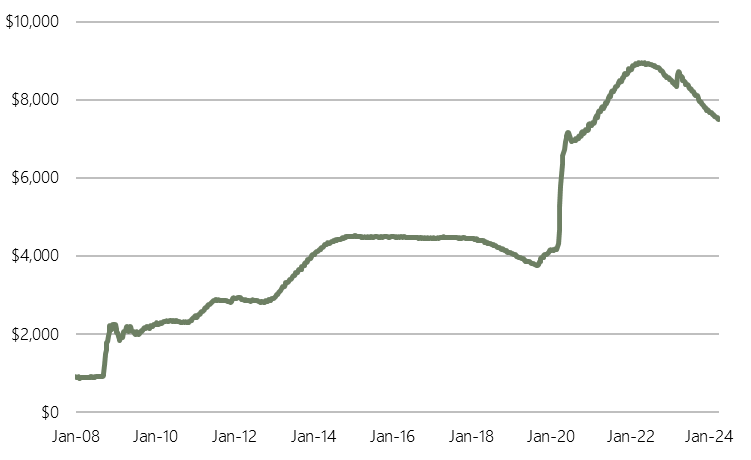

- The pace of QT will slow. Likely due to its complex nature, this topic never gets the attention that it should, particularly relative to Fed decisions on short-term rates. But it’s just as important, and arguably even more so. We don’t think it’s a coincidence that bank stocks began to recover when the Fed launched its QE bazooka in late March 2020, and then began to tumble when it was announced in March 2022 that QE would soon flip to QT. But just as QE was the primary driver of the massive growth in bank deposits during the early phase of the pandemic, QT had the opposite effect as liquidity was sucked out of the system over the last two years. The financial press tends not to give this topic as much “airtime”, again, due to its mind-numbing complexity, but this latest pivot is a huge development! Also, aside from the very largest companies, banks tend not to talk about this all that much either, likely because only the biggest banks see the direct impact through their activities as primary dealers, whereas it's a trickle-down effect for the smaller banks. For those that are interested, here is a good, easy-to-read primer on the subject (Link to Document).

Fed Balance Sheet

Source: FRED; Data as of 3/27/24

- The stocks are still cheap! We’ve hit this topic ad nauseum so we won’t rehash it here, but needless to say, bank stock valuations remain undemanding! While it’s true that the stocks have been cheap for awhile, there are now catalysts on the horizon that should bring the valuation argument more to the forefront.

- The bottom line is that investors are throwing up their hands in what looks to be a final sign of capitulation, just as the market backdrop turns more favorable.

- Potential landmines still to navigate. We devoted quite a bit of space to CRE last issue, and we will again in the future, so we won’t do it again here, but this clearly remains the most consequential overhang on the stocks. We don’t see any more “problem children” among the $100 bil+ asset crowd, and any bank below that size can be easily absorbed by a larger bank, so it’s not at all a question of potential systemic credit risk in our view, but rather a risk of continued overhang on the stocks should there be a hiccup from even a small company that could be construed as having implications for all CRE-exposed banks.

- Rates could also still move higher and have been lately. While the Fed seems determined to ease at some point, a resurgence of inflation could force the Fed’s hand. Significantly higher interest rates would almost certainly reignite liquidity concerns and exacerbate credit issues that, except for CRE, seem largely contained for now.

Thoughts on banks selling insurance businesses

Many banks have capitalized on a robust market for insurance business valuations by announcing sales of their insurance operations. On average, these sales have driven an improvement in tangible book value per share of about 11% for the selling bank. Stock price performance for the selling banks has generally been solid, reflecting the value realized from selling the insurance business at a significantly higher valuation than where it was carried on the bank’s balance sheet. The rationale for these sales to us seems sound. In many cases, banks are pulling forward about twenty years+ of the earnings these businesses are likely to generate. Value creation in the form of TBV improvement is meaningful and proceeds from the sale can be utilized to repurchase stock, fortify the capital base, and/or restructure the balance sheet.

Interestingly though, the robust valuations garnered in these sales isn’t translating to any significant revaluation for banks that are opting to keep their insurance businesses. For banks that are considering their strategic options over the next several years (i.e. remain independent or look for an upstream partner), the decision to sell their insurance business today is particularly meaningful. If the market isn’t assigning “credit” to banks’ insurance operations that they choose to keep in-house, then there isn’t any incentive for an acquirer to value the insurance business in line with current insurance sale valuations when valuing the entire bank on a sum-of-the-parts basis. So for banks contemplating a sale of their company in the next few years, it makes sense to us to sell the insurance business today in order to realize a benefit for shareholders that they won’t necessarily receive from an acquiring bank in a sale scenario a few years from now. Let’s assume an acquirer will pay 1.5x TBV for a bank in 12 months, and that the 1.5x multiple won’t change if the selling bank has an insurance business or not. If the selling bank can boost its TBV by 15%-20% today through an insurance sale, and credibly fill the earnings hole, it would conceivably garner 15%-20% more in a sale scenario for the entire bank, because the acquirer would still pay 1.5x the now-higher level of TBV for the franchise a year from now.

One other point on this topic. Trading patterns in some of these stocks after announced sales have been unusual, creating what we see as an arbitrage opportunity. As noted earlier, some stocks have reacted very well to the sale announcement news. We’ll highlight here two that we happen to own in our investment fund where the stock price reaction has been more of a head-scratcher. We owned both stocks prior to these announcements, and, in part due to the stock price reaction post-sale, we’ve added to our position in both. Generally speaking, we think poor investor sentiment and the lack of interest in smaller community bank stocks is part of the reason for the market’s lack of attention to opportunities like this in banks with less liquidity in the shares.

- CB Financial Services, Inc. (CBFV) announced the sale of its insurance business on 12/1/23. In the press release, the company noted that the sale would bolster TBV per share by 18%. Since the announcement, the stock is up 1.1%, compared to a 7.7% increase in the bank stock index, and with the increase in TBV now trades at just 86% of TBV vs. 109% prior to the sale announcement.

- Evans Bancorp Inc. (EVBN) announced its insurance sale on 11/7/23. The company indicated the deal would improve TBV by 19%. Since the sale announcement, EVBN stock has increased by 12.7%, exactly in line with the bank stock index, yet the valuation now sits at 91% of TBV compared to 103% prior to the announcement.

Bank stock observations

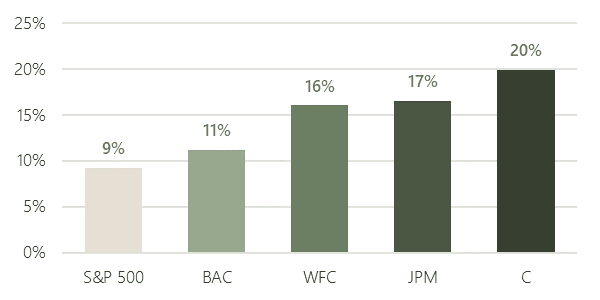

The S&P 500 gets all the attention, but big banks have been the place to be. The stock market’s fast start to the year has attracted plenty of headlines, but it’s the beleaguered bank sector’s largest banks that have been among the market’s top performers. Each of the four largest banks, led by Citigroup (C), up 20% YTD as of 4/3; followed by JPMorgan Chase (JPM), up 17%; Wells Fargo (WFC), up 16%, and Bank of America (BAC), up 11%, have outperformed the 9% increase in the S&P 500 Index since the start of 2024. JPM is now up 48% since the start of 2023 (compared to the S&P, up 35%), a period that included a bank sector liquidity crisis, and historically poor investor sentiment towards the bank sector. In fact, since the start of 2023, JPM has even outperformed two of the seven stocks that comprise the vaunted “Magnificent 7” that have led the market higher over the past few years.

We’re surprised that these facts aren’t garnering more attention. We also think from these valuation levels, the largest banks are providing a roadmap of where the sector is headed as remaining storm clouds dissipate and persistent fears of Armageddon finally cease. In the meantime, we think it’s reasonable to suggest that the largest banks have never been stronger, and that recent developments have further improved their standing, which of course the market has anticipated in advance.

The four big banks will all benefit from fewer rate cuts than was anticipated at the start of the year – remember, NII guidance from these banks on Q4 earnings calls reflected six rate cuts. With two, maybe three now expected, NII projections will likely prove too conservative. CECL also requires these banks to aggressively provide for potential recession, which until recently has been the base case consensus view. With recession now much less likely, these banks will likely find it increasingly difficult to justify current reserve levels. Regulators have also recently confirmed that proposed capital rules, which disproportionately impacted the largest banks, will be reconsidered (i.e. watered down), likely driving increased capital return as new rules are finalized later this year. Finally, capital markets activity (IPO and M&A) is rebounding, providing yet another earnings driver for the largest banks that house large investment banking operations. And from the standpoint of risk, these banks have the lowest concentration of commercial real estate exposure, currently the main overhang on stock price performance for the sector at large. The bottom line is that big banks offer an unmatched combination of defense against the sector’s main risks (CRE and rates) and offense with the pick-up in revenue drivers and capital return.

Big Bank Stock Performance in 2024

Source: S&P Global; Data as of 4/3/24

Other tidbits we found interesting

Regulators and certain politicians abhor the thought of the largest banks getting bigger, but there are considerable challenges for mid-sized banks looking to take the leap to large bank status. Look to NYCB as Exhibit A (Link to Article).

We’re seeing lots of interest from high-net-worth investors looking ahead to potential Fed rate cuts and contemplating how to replace attractive risk-free returns on cash. We continue to favor bank preferreds, which we believe on a total return basis offer about double the current return on cash with moderately more risk (Link to Article).

While we’re bullish, we’ve consistently acknowledged the potential pitfalls still ahead. Stock picking is more important than ever (Link to Article).

See the article link below for another “smart money” voice warning about froth in private credit markets. Very confounding to us how investors are terrified of CRE on bank balance sheets but have little concern about higher yielding CRE with little understanding of underwriting practices, few disclosure requirements, and no regulatory oversight sitting in private credit funds at companies trading at all-time highs (Link to Article).

We asked earlier “who is left to sell bank stocks that hasn’t already done so”. That statement applied to investors selling purely for fundamental reasons. If these guys become forced sellers, it could be a problem (Link to Article).

Disclosures:

Of the individual stocks mentioned, our investment fund currently has long positions in Wells Fargo & Co. (WFC), JPMorgan Chase & Co. (JPM), Bank of America Corp. (BAC), Citigroup Inc. (C), CB Financial Services Inc. (CBFV), Evans Bancorp Inc. (EVBN), and preferred stock in New York Community Bancorp, Inc (Series A). The author(s) has long-standing long positions in Citigroup Inc., and JPMorgan Chase & Co. in his personal investment account, an investment that pre-dates the launch of our investment fund.

The information in this newsletter does not constitute an offer to sell or a solicitation of an offer to buy any security. This information does not purport to be complete, is subject to change, and is qualified in its entirety by the definitive offering documents related to any private fund managed by GenOpp Capital Management LP. All time-sensitive references are made as of the date set forth above, unless otherwise expressly indicated, and there is no obligation to update any such reference. The delivery of this information does not imply that the information is correct and no representation or warranty is made as to the accuracy of any information contained herein. This information is not a recommendation to buy any security and does not constitute any form of legal, tax, investment, or other advice.