Banks Restructure Balance Sheets To Boost Earnings And Liquidity

Summary

-

A number of banks proactively restructured their securities portfolio as rates started to level off and decline in late 2023

-

The goal is boosting earnings through margin expansion and improving liquidity by paying down higher priced debt or funding

-

The Street has generally accepted these transactions with over 70% of the bank stocks outperforming post announcement

-

We also walk through some of the potential risks as the market moves through a changing rate environment

The Battleships Are Turning As Banks Look To Increase The Steam

With yields down from October 2023 highs, a growing number of banks are proactively restructuring their securities portfolio, while some have gone even further by capitalizing on high multiples to sell business lines; all to achieve a more flexible and stronger balance sheet. What’s interesting is a strong majority of banks outperform the peer index post announcement, despite what some might think of as misguided action to realize an accounting loss that would eventually recover in time. Below we dive deeper into why banks are making this move, the process and moving parts behind the transaction, and finally the response by the street and what is likely to happen from here.

So How Did We Get Here?

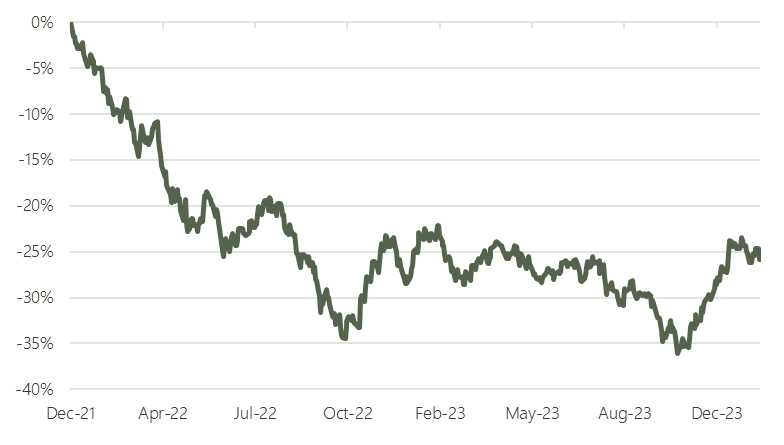

Banks are among the largest holders of financial securities like corporate bonds, mortgage-backed securities, collateralized debt, and treasuries for several reasons including liquidity management, income generation, and risk alternatives. While this has and likely will always be the case for banks, the historic level of liquidity pushed into the system (by our count 300% higher compared to the Global Financial Crisis in 2008) during the most recent pandemic created a situation in which banks found themselves with the largest amount of idle cash in recent history and the byproduct being an increase of securities holdings. The second step was another never-before-seen sequence of events, namely a historic rise in rates in a truncated timeline. These moves were not without repercussions, holders of fixed income securities saw substantial decline in the value of their portfolios; for reference the Vanguard Long-Term Corporate Bond Index Fund ETF (VCLT) which tracks the long-term corporate bond index was down ~28% from the start of the rate hikes in March 2022 to mid-October last year and nearly 40% from peak to trough.

Vanguard Long-Term Corporate Bond Index Fund ETF (VCLT)

Source: S&P Global, Data As Of 1/16/24

The Process Is Simple And The Results Are Promising

With these “temporary” (remember bonds typically move to par over time) double digit declines in bond values, banks are faced with decision: hold the bonds until maturity or sell them at a loss and use the capital for alternative options. The banks that decide not to restructure typically fall into a couple camps: first, they simply don’t need to either because of low exposure to the issue, they have significant hedges against the rate move or the portfolio is quickly running off; second, capital is needed elsewhere and the loss can’t be “realized”.

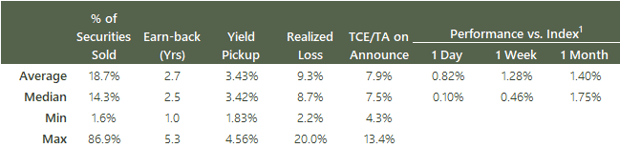

For those who chose to restructure the accounting is relatively simple, selling low yielding assets at a loss and reinvesting into higher yielding securities, making additional loans (at higher yields), or paying down higher cost debt/funding. Out of the ~50 public banks we’ve investigated that have announced restructuring the median pick up in rates is ~340 basis points, not too bad. The loss taken on the sale is typically under 9% of the total restructured amount and is almost always already included in the stated capital position (book value) as these “available-for sale” securities are marked to market each quarter. So like M&A, the accounting is summarized by reviewing the earn-back on the transaction or in other words how long it takes to recoup the loss to book value. Thus far, these earn-back timelines are coming in on average just under three years; this compares favorably to the typically accepted M&A deal timeline of 3-5 years (and without the execution risk of a deal).

Balance Sheet Restructuring

1 SPDR S&P Regional Banking ETF (KRE) Source: S&P Global, Data As Of 1/22/24

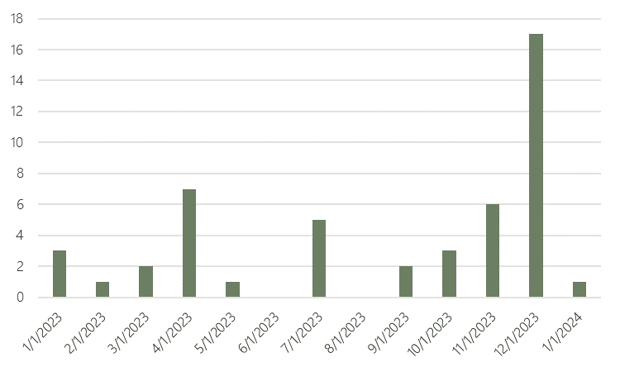

While the majority of announcements we looked at have been in 2023, the pace of the announcements significantly increased during the last two months (December being the most frequent) of 2023; likely correlated with Chair Powell's comments in late November. The most well-known, or more appropriately, most infamous announcement is undoubtedly what kicked off the downfall of Silicon Valley Bank. One can easily see why other banks might’ve been hesitant to announce a similar transaction earlier last year, but the market outside of that one instance has resoundingly accepted the results. We have proactive management teams seeking to increase the profitability of the bank, generating balance sheet flexibility, and essentially turning the battleship quicker than expected. Given the transaction has almost zero execution risk and is immediately accretive to earnings one would expect a positive response from the market.

The results when comparing the individual bank stocks to the SPDR S&P Regional Banking ETF (KRE) validates that assumption. As seen above, stocks outperform the relative benchmark on each time measurement and interestingly ~70% of stocks outperform the KRE the day of the announcement. While the total outperformance isn’t earth shattering, the validation to us is more that the market views realization of the losses not a sign of issue or trouble, but a smart transaction to help bank profitability and flexibility which in turn is a boost to shareholders. Inevitably this will slow for two reasons: first, there are simply less banks that need to make this move; and second, with rates ticking up recently there may be more of a wait and see approach as significant increases to rates from the date of the trade would essentially restart that inverse relationship between rates and bonds all over again. That said, for banks that have already swapped their bonds we wouldn’t expect nearly the size of issue as before because they should be able to lower their duration due to the shape of the yield curve. A large portion of the restructure can also go to paying down debt or higher cost funding, and the remainder that wasn’t restructured is starting to mature given we are now several years away from the mass influx of liquidity.

What Are The Risks?

As mentioned above the risks are materially lower than a comparable M&A deal, but there is no free lunch unfortunately. We see a couple risks to the success of the transaction:

- First, the earnback timeline is dependent upon the consistent payments from the bonds. In a scenario where rates moved significantly lower from here and the bank invests in mortgage backed securities for example, there is a higher likelihood that those bonds would be repaid at a quicker rate than expected thus extending the earnback period.

- Secondly, if the bank decides to use 100% of the sale proceeds for bond purchases, and in an effort to further enhance the yield pickup decides to extend duration and maturity, the bank is in the same or potentially more difficult position if rates were to rise in a similar fashion to what we saw earlier in the cycle.

- Finally, while more anecdotal it's hard not to see the concentration of bank announcements as a possible capitulation in the near-term rate cycle or an example of the group think construct. Since year end, the 10 and 2 year treasury rates have moved slightly higher and the ETF proxy (ticker: VCLT) is down low single digits as expected.

Balance Sheet Restructuring Announcements Source: S&P Global, Data As Of 1/22/24

Source: S&P Global, Data As Of 1/22/24

While the risks contain quite a few "ifs", they aren't without concern. That said, if a bank's securities book is currently earning close to 1% and could basically change overnight to 4.5% it's hard not too see the restructuring as a positive considering the current information available to CFOs with the most likely outcome of rate environments being accommodating to the change.