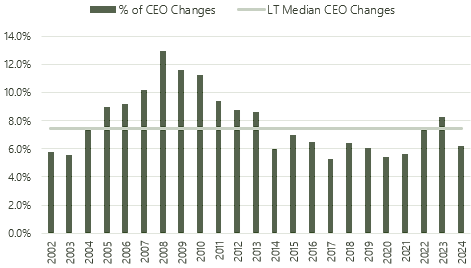

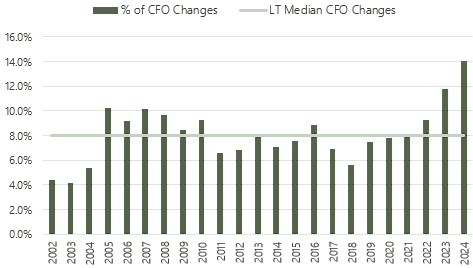

The Great Resignation, performance concerns, or just simply a wave of succession?

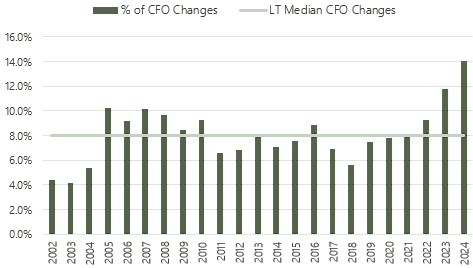

Over the past several years there has been a continuous rise in the level of turnover among the top-level executives across the country. Given the lower turnover for years, search for increased profitability, and a new normal of lower tenures post-COVID; the rate of executive turnover, specifically CFOs, has grown to historical highs.

Number wise, last year 12% of publicly traded banks announced CFO transitions, which represents a 50% increase from the long-term average and a 20% increase over the GFC peak. 2024 is off to an incredible start with an annualized pace of over 14% turnover which is 75% higher than average and 37% higher than GFC peak. Consider these astonishing numbers with the fact that for most regional and community banks the management teams are one of, if not the most important factor in a bank’s long-term performance.

CEO & CFO Historical Turnover

Source: S&P Global; Data as of 3/31/24

In our view, there are several factors at work here:

- First, calling back to the Global Financial Crisis (GFC), the industry saw an obvious increase in the turnover of management which carried on as the banking space sorted itself. As normalized turnover levels were pulled forward, the industry had just short of a decade trough.

- Second, succession is natural, whether it's the CFO or CEO there can be one for one or wholesale changes to the executive team on a single retirement. With CEO's average age in the low 60's it's no wonder changes would happen.

- Third, as banks search for scale the Board can look for execs more adept at managing higher asset levels; a scenario likely increasing as banks face tougher tests around asset caps.

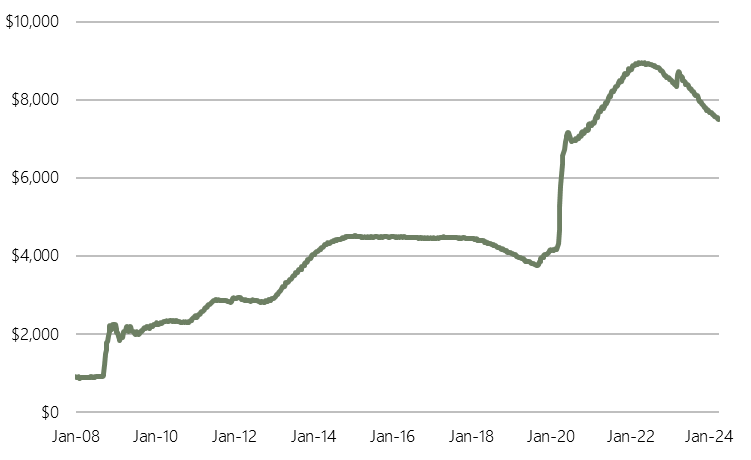

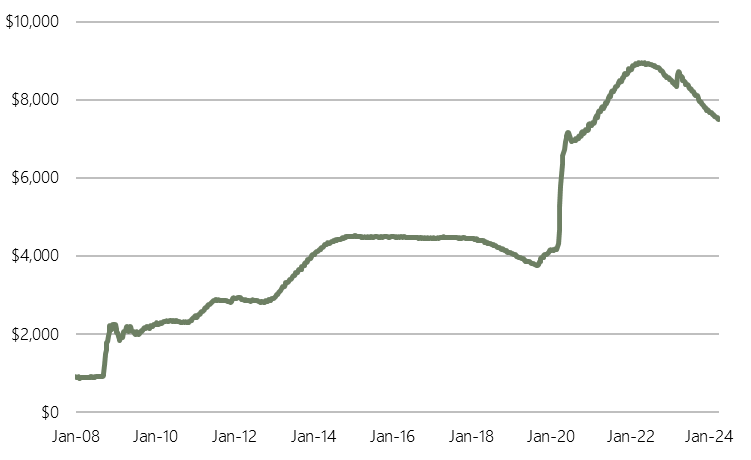

- Industry performance recently has been below longer-term trends as the impact from massive liquidity influx and its reversal coupled with a rapid change in the rate environment, specifically the shape of the curve. These headwinds over the past two years are focused on the balance sheet as funding costs have rapidly outpaced loan repricing and as we mentioned here (Balance Sheet Restructuring) securities portfolios were hit industry wide.

Fed Balance Sheet Source: FRED, Data As Of 3/27/24

Source: FRED, Data As Of 3/27/24

So consider the position that a bank’s management team found themselves. Your deposits move up ~30% in a short period which directly lowered the performance of the bank as margins decline. To offset the margin degradation Bank boards, ALCO (Asset-Liability Committee) teams and investors were looking for a boost. Banks couldn’t move all that new funding to loans quickly for a few reasons:

- Regulators would’ve been putting on the breaks, especially after 2023's turmoil.

- It’s quite difficult to match long term loans with lighting fast deposit increases and even more perilous if those quick deposits decide to exit.

- Ill advised to become aggressive lenders overnight with significant economic uncertainty.

- Securities have typically been a source of strength for banks and offer more flexible maturities.

Banks mostly chose the last option to varying degrees and looked to add to their securities portfolio; this is where some struggled as rates expanded and the curve inverted, negatively impacted the value. While not everyone went farther out to find yield, hindsight does say long duration fixed securities were a mistake (for example, buying the average MBS is similar to simply making a long-term mortgage). As rates eventually leveled off those who went long duration had a choice to realize losses through the restructuring of investment portfolios. Unfortunately those banks that did had a 24% level of CFO turnover since the start of rate hikes in March 2022 (reminder that’s nearly twice the elevated industry rate).

For us, it’s quite difficult to say the massive number of changes are wholly deserved given the historic liquidity inflows & outflows, a bank run no one predicted akin to 1907, and a never before seen rate environment. It’s no wonder the industry has had a difficult time managing the whipsaw; we don’t blame them! Bank balance sheets are giant battleships that take time to turn, and that battleship aspect is why banks are significantly protected from the worst of outcomes (even more so than pre-2008). There’s little question in our mind that banks have leaned on their CFOs more heavily than ever the past two years and will continue to do so for the foreseeable future. Yet in this case, it appears they are taking the brunt of the changes.

All this change in leadership does raise some questions from investors:

- Who is replacing the outgoing CFO and are they more capable than their predecessor?

- Is this simply change for the sake of change, i.e. the fall person, and does the core decision making remain the same?

- Does the balance sheet positioning materially change under new leadership?

- Are there other issues around the corner?

Time will tell as we are still in the throes; but with the industry seeing a bottoming (and the beginnings of expansion) in margins, a signal from the Fed that Quantitative Tightening will taper off, a more predictable funding environment, and buybacks restarting things are looking up. Credit remains the wildcard as CRE concerns have painted the industry with a broad brush, however banks appear much better equipped than ‘08 with significantly higher capital levels, better underwriting standards, more diversified loan books, a more narrow focus in perceived hot spots vs blanketed issues in '08, and higher reserve balances.